Germany’s burgeoning Bitcoin mining landscape is rapidly evolving, inviting both novices and seasoned enthusiasts to plunge into the world of cryptocurrency mining. For those stepping onto this digital frontier, understanding the intricate dance between mining machines, hosting services, and the volatile cryptocurrencies themselves is paramount. Bitcoin, the pioneer of decentralized currency, remains the centerpiece of many mining ventures, yet emerging coins like Ethereum and Dogecoin inject fresh dynamics that shape mining strategies and equipment choices.

Diving headfirst into mining begins with the heart of the operation: the mining rig. These machines, specially designed to solve complex cryptographic puzzles, validate blockchain transactions and, in doing so, earn rewards in the form of cryptocurrency tokens. Germany’s cold climate offers a natural advantage, reducing the need for energy-intensive cooling and thereby enhancing the operational efficiency of these rigs. For beginners, selecting an optimal rig involves balancing hash rate performance, energy consumption, and budget constraints—decisions that either lead to profit or loss in this fiercely competitive arena.

Yet, buying a mining machine is just part of the puzzle. Hosting mining machines—leasing space in specialized data centers designed to optimize power and cooling—has surged as a preferred option. These mining farms, often located in regions with renewable energy sources and affordable electricity, provide a sanctuary where rigs operate uninterrupted. For Germany-based miners, partnering with hosting providers mitigates issues like fluctuating energy costs and local regulations, allowing them to focus on maximizing mining output. Moreover, hosting services often bundle maintenance and security, dramatically easing the operational burden on individual miners.

Bitcoin mining is notoriously energy-intensive, demanding considerable electricity to maintain competitive hash rates. Germany’s stringent energy policies push miners to seek greener solutions such as wind, solar, and hydroelectric power. This shift not only aligns with environmental priorities but also promises economic relief by reducing operational costs. Additionally, as Ethereum transitions towards proof-of-stake mechanisms, Bitcoin mining’s proof-of-work consensus remains a crucial pillar, underlining the ongoing relevance of dedicated mining rigs tailored for Bitcoin’s algorithm, SHA-256.

Meanwhile, diversification in the mining ecosystem is gaining traction. Ethereum miners, once keen on GPU-based rigs, are transitioning strategies as the Ethereum 2.0 upgrade reshapes the landscape, potentially diminishing GPU mining’s profitability. Yet, Dogecoin—a meme-based coin with a passionate community—offers an intriguing, albeit volatile, alternative. Though Dogecoin mining shares infrastructure with Litecoin through the Scrypt algorithm, enthusiasts appreciate its faster block times and lighter difficulty, which can translate into quicker returns on investment.

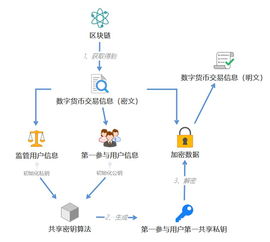

Exchanges complement this ecosystem by providing liquidity and seamless conversion of mined tokens into fiat or other cryptocurrencies. German exchanges have integrated robust security measures, ensuring miners can confidently trade their rewards. This symbiotic relationship between mining operations and exchanges is vital; miners’ profitability depends not just on mining success, but equally on the timing and means of converting mined coins within volatile markets.

For beginners, setting up a mining operation in Germany involves a multi-step approach. First, assessing power costs and identifying favorable hosting arrangements can dramatically influence the choice between owning a physical mining rig or outsourcing to a hosting facility. Next, selecting the right mining pool—where miners combine computing power for steadier returns—and configuring mining software tailored to Bitcoin’s or alternative cryptocurrencies’ protocols are critical technical steps. Lastly, staying informed about regulatory shifts—Germany’s crypto policies evolve frequently—is necessary to ensure compliance and sustainability.

The interplay between hardware, hosting, and blockchain networks forms a dynamic mosaic that defines Germany’s Bitcoin mining realm. By harnessing technological advancements and marrying them with ecological prudence, miners stand poised to carve profitable niches in this electrifying industry. For anyone aspiring to join the ranks of digital miners, this setup manual serves as an indispensable guide, highlighting the seamless blend of innovation and tradition fueling cryptocurrency’s future in Germany.